JYNT Q1 2022 Earnings Review

Core thesis remains strong; management's double down on "growth at all costs" yields new price target of $14.80

Lead analysts: Kevin Zeng, Sze Yu Wang, Emilio Lara, William Ko, Christopher Ko

For those who haven't read our initial short report on Joint Corp (NASDAQ: JYNT), you can find it here. This update post will discuss 22Q1 earnings, some modeling updates, & BIG’s position on JYNT post-earnings.

22Q1 Earnings Print & Transcript

The Earnings Print

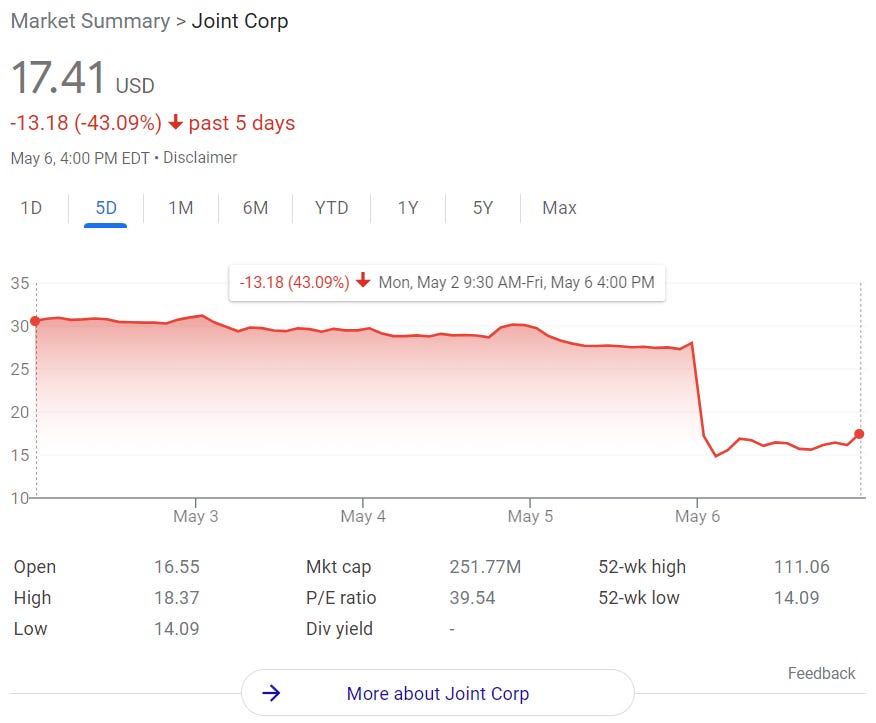

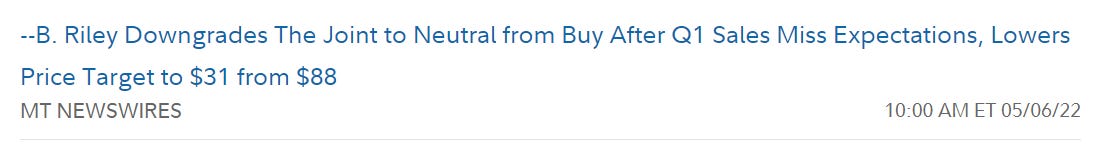

JYNT posted 22Q1 earnings after-hours on May 5th, and the stock traded down ~40% on May 6th market open, at some points nearing (50%). This drop was fueled largely by JYNT's deteriorating profitability due to major G&A expense increases (more on this later) — which led sell-side firms to downgrade JYNT’s PT. See below.

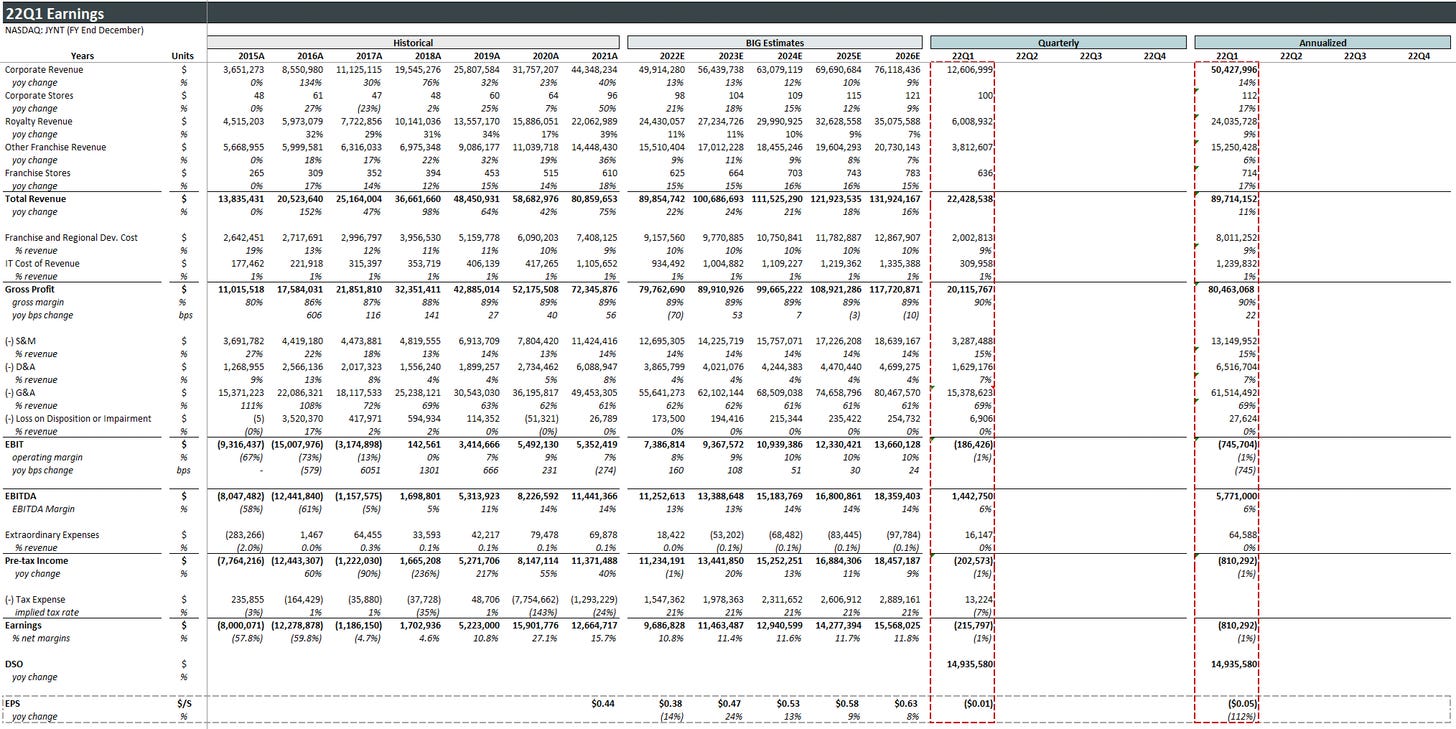

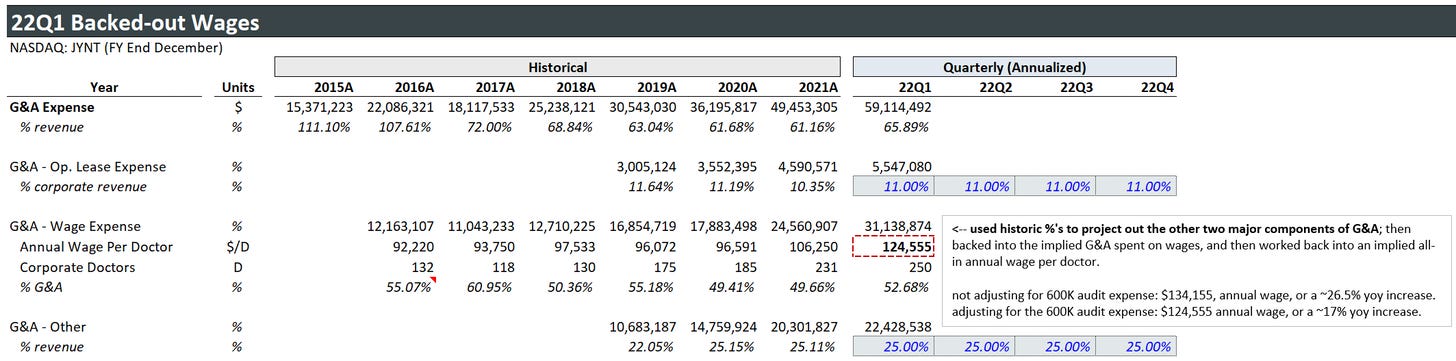

As you can see below, G&A, which historically has hovered somewhere around 61-63%, was up to 69% of the quarter’s revenue. They did, however, mention a 1-time $600,000 G&A expense attributable to auditing. Assuming that is purely one-time, the G&A expense is still 66% of revenue, far above prior years.

Highlighted in red are the quarterly results, along with the annualized version of them (quarterly revenues/expenses/openings multiplied by 4). As we mentioned, expenses across the board rose, resulting in a negative (1%) EBIT margin, compared to an average of 8% across the last three years. Store openings came in at 30; slightly lower than sell-side estimates, but still a record # of openings for JYNT. Mgmt trimmed guidance for store openings to 110-130 by year-end.

The Earnings Transcript

Moving on from the print itself, there were many notable quotes from the transcript:

We, like the rest of the country, have been impacted by the larger macroeconomic issues such as inflation, rising interest rates and the tight labor market. These dynamics have contributed to higher turnover and rising labor costs. As discussed in Q4, we raised the starting and average salary of our doctors of chiropractic or DCs. Regarding our wellness coordinators, over the past year, we have increased the complexity of their job responsibilities, which has led to increased turnover. In addition to the DC and WC, we had significant turnover in our field support. As such, in Q1, we redefined the roles and started adjusting their compensation accordingly. - Jake Singleton, JYNT CFO

Reading between the lines, we believe Jake is sugarcoating the fact that wellness coordinators (WCs) and doctors of chiropractics (DCs) were being overworked (“increased job complexity”), and thus wages had to be adjusted upwards to accommodate that.

With the easing of COVID restrictions, we were able to participate in 5 live chiropractic industry and university DC recruitment events, and we remain focused on the developing new programs aimed at chiropractic students who are the future of the profession, along with the continuing education opportunities that appeal to established working DCs. - Peter Holt, JYNT CEO

While this is definitely a good move towards improving their reputation, there are over 20 accredited chiropractic schools and 40 total chiropractic schools. It may be a while before JYNT is able to turn around its reputation. We continue to monitor their recruitment efforts to see their effectiveness. Thus far, we believe it has had a low impact.

I think that the [wage] increase that we had on the DCs last fall has really helped us to retain the doctors that we have. So if I look at our turnover rate for the last 3 months in Q1 and compare that to the turnover rate of Q1 '21, it's 50% better. So this quarter was 26% turnover for our doctors compared to over 52% in Q1 '21… listen, our whole concept rests on doctors and so we know that we constantly have to be focused on recruiting and retaining the best doctors and that's why that's one of our enterprise initiatives. - Peter Holt, JYNT CEO

52% doctor churn! Wow. While it has improved to 26%, Peter seems to attribute most of it to wage increases, which feeds into the bear thesis. The reporting of these churn numbers points to our original thesis of JYNT overworking their doctors without adequate compensation or support.

there are a couple of factors that impacted the slowdown in particularly the corporate clinic performance and … the most significant one was the higher turnover than expected with our WCs and our field support. Is that when you have that turnover and those are the people who are really driving that line performance and that WC is essential in the clinic. - Peter Holt, JYNT CEO

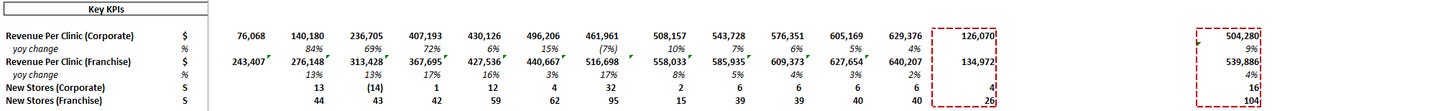

Less direct, but we think this points to average revenue per clinic reaching a lower limit in the face of an overworked employee base, validating our original thesis.

Modeling Updates

Our original thesis revolves around a doctor shortage and terrible work culture, resulting in JYNT having fewer hires, and consequently, fewer store openings. After reflecting on management’s actions and guidance in 22Q1, however, we decided to revise our thesis to better reflect reality — mgmt has historically pursued growth at all costs, and 22Q1 results show that they continue to prioritize hitting targeted store openings, even if that means less profitability. That is, instead of assuming JYNT will keep wages low, resulting in fewer hires and fewer store openings, we think JYNT will instead choose to jack up wages to meet guidance on store openings.

For the sake of simplicity, we will call our original thesis the “higher margin, lower growth” scenario, and our revised thesis the “lower margin, higher growth” scenario.

Revisiting the 22Q1 print, management openly admits to adjusting compensation numbers for DCs and WCs. Using previous years as guidance, we were able to back out the implied % of the G&A spend on DCs.

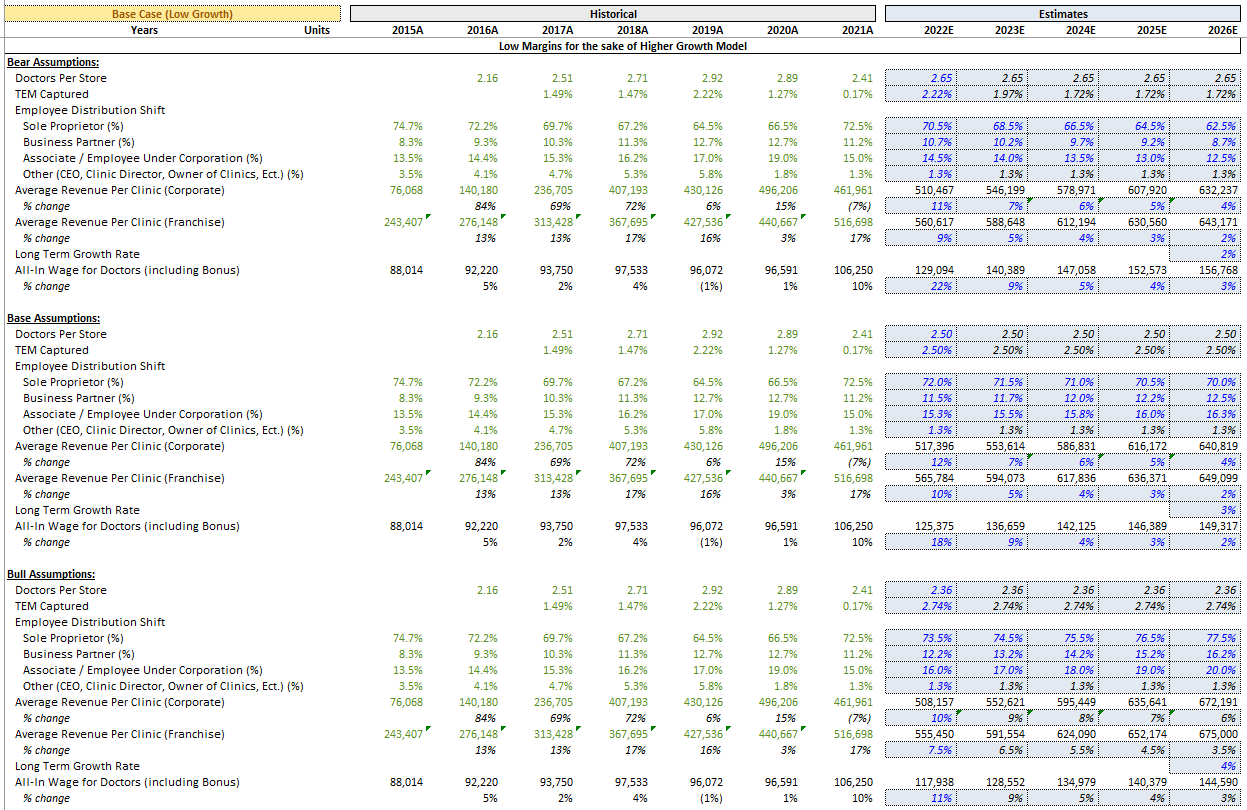

Assuming the 600K auditing expense is (1) not recurring and (2) not captured by G&A -other, our calculations suggest that the all-in wage for a DC at JYNT is about 125K, nearly 17% higher than last year (106K all-in, comprised of 85K base, & 25% bonus). Using this as a baseline, we constructed new bull, bear, and base scenarios for the “lower margin, higher growth model.”

Most assumptions remained unchanged, we mostly tweaked % of TEM captured (supply) so that store openings would be more in-line with management guidance and modeled in wage hikes consistent with previous calculations. We also tweaked doctors per store & average revenue per clinic to have less variance across the three models — our previous numbers were attempting to be too exhaustive of all outcomes rather than focusing purely on being right.

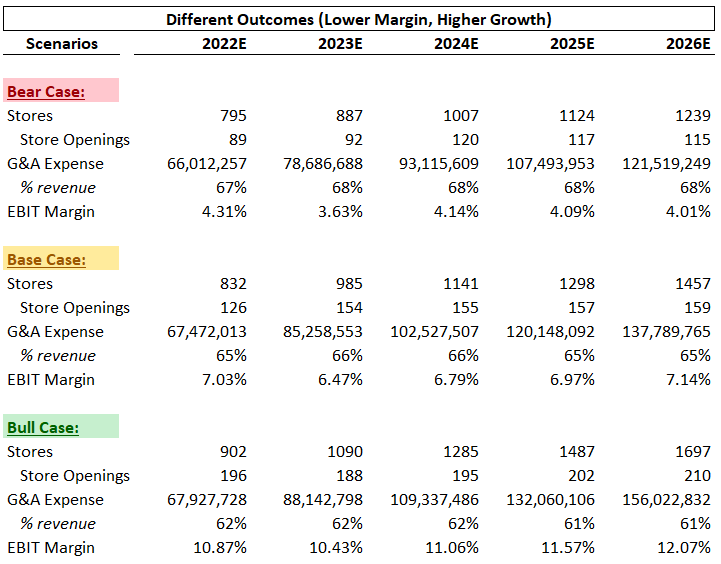

With that, below is what the numbers look like under the “lower margin, higher growth” scenarios.

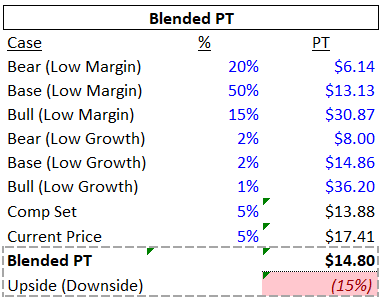

Given management’s “growth at all cost” mentality, our blended PT gives a substantially larger weight to the “lower margin, higher growth” compared to the original “higher margin, lower growth” scenarios. Our new blended PT is $14.80, 15% below current levels.

BIG’s Position on JYNT Post-Earnings

As of May 6th, BIG has exited its short position on JYNT at about $16.5, up roughly 50% since we initiated the position.

We chose to cover our short completely because we felt that the risk-reward on the stock is now much less asymmetric.

This quarter’s print seems to be evidence — though not complete & comprehensive evidence — for our thesis on JYNT’s terrible working culture and supply-side constraints. It could be argued that as the thesis continues to evidence itself in financial results, JYNT price would continue to crater. That is, if the market is pricing in $17 on signs of supply-side weakness from JYNT, if and when the thesis is fully confirmed, Joint should trade at even lower levels than now. In that case, we ought to hold.

We believe the above view to be a bit too rosy and naive. Markets tend to be efficient, and if our price target has been breached (or mostly), we should choose to profit-take while we can. We will stay on the lookout for possible re-entries on the stock as the price fluctuates. It’s possible that the 40% drop seen today could recover tomorrow, in which case, we are more than willing to size back in.

The Team (Sze-yu on the left, Chris cracking Kevin’s back, Will on the right, Emilio second on the right)

Legal Disclaimer: As of the publication date of this report, Berkeley Investment Group no longer has a short position in the stock of The Joint Corp. In addition, others that contributed research to this report and others that we have shared our research with likewise may have short positions in the stock of The Joint. The Authors stand to realize gains in the event that the price of the stock decreases. Following publication of the report, the Authors may transact in the securities of the company covered herein. This article is not investment advice and represents the opinions of its authors, Berkeley Investment Group. You can reach the authors by email at berkeleyinvestmentgroup@gmail.com. This document is for informational purposes only. All the information contained herein are from public sources believed to be accurate and reliable. Berkeley Investment Group make no representation either expressed or implied as to the accuracy, timeliness, or completeness of any such information or results obtained from its use. All opinions are subject to change without notice.