BIG is SHORT on Joint Corp (NASDAQ: JYNT)

Blended price target of $16.38 implies a 47% downside

Lead analysts: Kevin Zeng, Sze Yu Wang, Emilio Lara, William Ko, Christopher Ko

The Joint Corp. (NASDAQ: JYNT) trades at lofty NTM multiples of 4.5x sales, 29.6x EBITDA, and 95.9x P/E indicating that the market believes growth can continue hinged on the back of their rapid and aggressive growth in franchise and own/operated store growth. However, given primary analysis done on store economics depicting an overworked and slowing franchise base, increasing labor market headwinds, competition eroding profits, sketchy management antics, and a backlog of negative customer sentiments, we believe that the future is bleak for the Joint Corp. We believe that aggressive store openings are not a sustainable strategy in the long-run and continued internal problems pose impending issues for shareholders.

Subscribe to Berkeley Investment Group for 1-2 high-quality investment ideas each quarter.

What is JYNT?

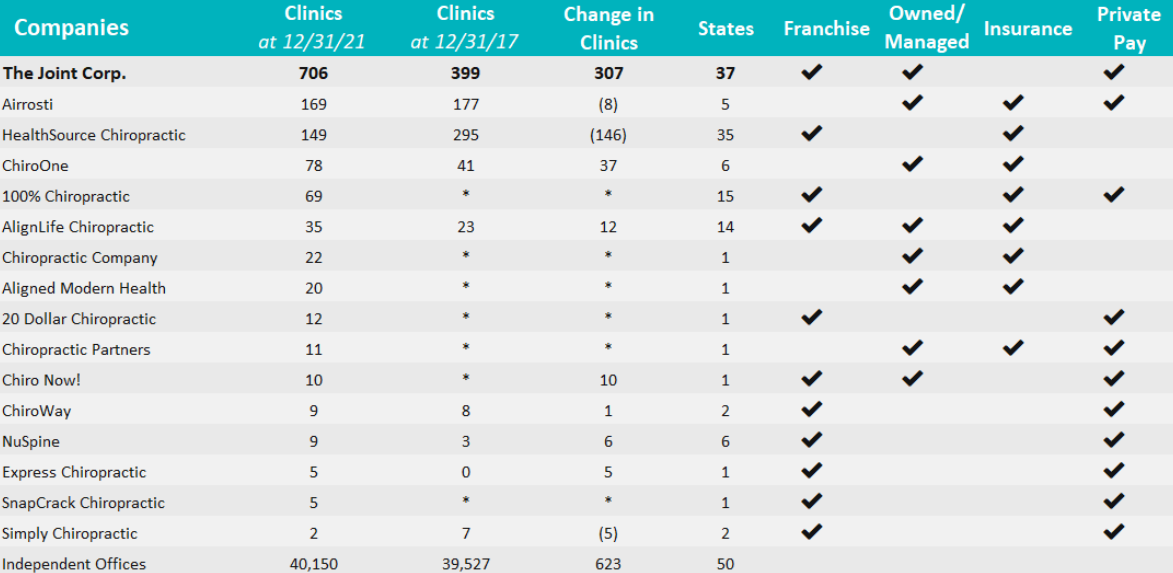

JYNT is a cash-based affordable chiropractor focusing on non-acute treatment. It operates a total of 706 stores (96 corporate, 610 franchise). 55% of revenue is attributed to company stores, and the remaining 45% is driven by franchise stores, which includes royalty fees, franchise fees, advertising fund revenue, software fees and regional developer fees.

Currently, most chiropractic services are provided by sole practitioners (~70%), unlike JYNT stores which employ an average of 2.4 doctors. The majority of traditional chiropractors are set up to accept and to process insurance-based reimbursement (most job-based health insurance plans cover some portion of chiropractor visits, many ACA plans cover chiropractor visits, and Medicare covers any chiropractic treatment that is “medically necessary”), meaning they incur overhead expenses associated with processing third-party reimbursement. As a result, JYNT’s cash-only model allows it to offer lower prices than most players. In addition, this allows JYNT doctors to spend more time on patient-facing work rather than insurance paperwork, which JYNT uses as a selling point to attract new doctors.

JYNT also focuses on a high-volume approach and operates on a first-come-first serve basis. Each appointment takes only 15-20 minutes for new patients and 5-7 for returning patients, which alongside not having to process insurance paperwork and a high number of doctors per store, enables JYNT to see a higher # of patients/day than most competitors.

Thesis 1: Aggressive franchise store expansion strategy is set to be severely hampered by supply-side constraints

On the surface, JYNT’s business model is built around providing an attractive work environment for chiropractors where their cash-based model allows doctors to focus exclusively on patient-facing work as opposed to tedious insurance paperwork. However, we believe that JYNT has had issues attracting new doctors and retaining existing doctors, which will severely constrain their ability to open new stores at the rate implied by management’s guidance.

Since 2015, the company has grown its number of franchise clinics at a ~15% CAGR and management projects JYNT to hit a total store base of ~1000 clinics by 2023. In conjunction, revenue per clinic for both franchise and owned stores have also grown at a healthy mid-teens CAGR in the same timeframe. However, we believe that on a go forward basis, this strategy cannot continue.

Subpoint 1A: Declining unit economics suggest that further store openings will be near impossible.

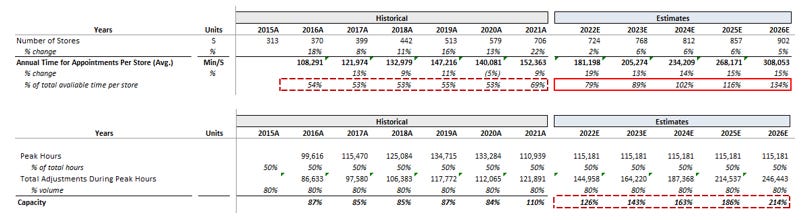

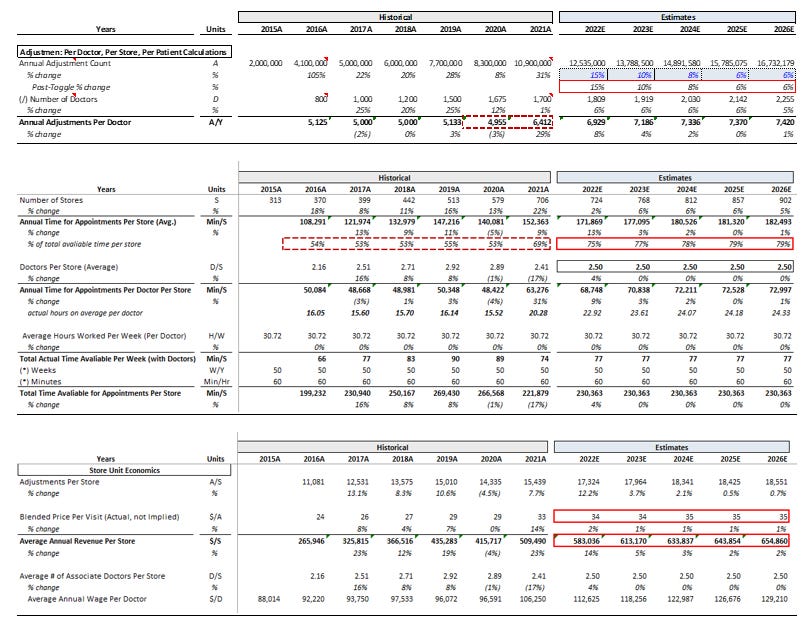

a) FY 2021 results reveal that average doctor counts are lagging total adjustments per store

As can be seen, JYNT’s doctor count has historically kept up with annual adjustment counts, however, in the most recent fiscal year 31% YoY growth in was matched only by 1% YoY growth in the number of JYNT’s doctors. This led to a 29% jump in adjustments per doctor, which is especially concerning given the adjustments/doctor metric historically has stayed fairly constant. Diving deeper, we can see that comparing doctor counts to net store openings implies a substantial number of existing doctors left JYNT in FY 2021. JYNT opened 127 new stores but only employed an additional 25 doctors.

Sensitizing the number of doctors per new store based on the average doctors per store from FY 2020 (2.89) shows that, unrelated to store closures, JYNT lost anywhere from 293 to 356 of their employed doctors, representing 17.46% to 21.25% of their existing doctor base from FY 2020.

b) Rising adjustments per doctor and difficulty attracting new doctors has led to an unsustainable uptick in workload for existing doctors.

Recent increases in hours have resulted in management having to take additional steps to ensure the health (mental and physical) and reduce the strain of their doctors. Due to high workloads, the company has instituted a mandatory break from 2pm – 2:45pm everyday to cope. We estimate that, from 2020 to 2021, the time chiropractors spent seeing patients increased by ~3 hrs per week. Given that the job is relatively labor intensive (causes fatigue easy since it requires a lot of force), this 3-hour bump can be seen as relatively sizeable as over the past 4 years, jumps in workload haven’t occurred much.

Additionally, JYNT Chiropractors now see on average 24% or ~1500 more patients than the industry average per year. This discrepancy is largely due to JYNT’s decision to push ahead with aggressive store openings despite a tight labor market, resulting in an increasing volume of work being shared among less doctors. The increased hours and per doctor patient visits all indicate a rapid and unsustainable increase in workload.

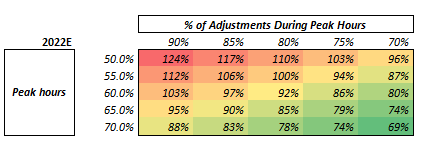

Taking this analysis further, if we calculate an implied utilization of doctors in the form of % of total time available per store we can see that in 2021, there was a ~16pp increase to ~69% in the amount of total time being taken up. This percentage shows that of all available time feasibly possible to work, ~69% is already being used up on appointments alone (assuming an extremely conservative 3 minutes in between appointments and not factoring in peak hours).

When factoring in peak hours, this percentage looks a lot worse.

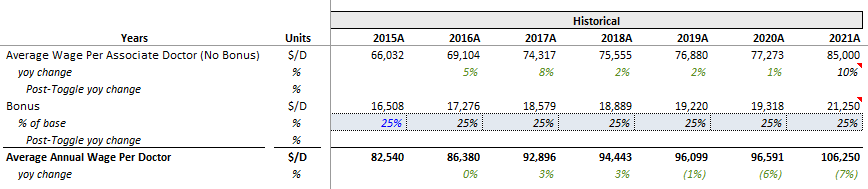

c) DC’s aren’t getting appropriately compensated for the additional workload and stress.

In addition to increasing workloads, JYNT chiropractors are only being paid ~4% higher than the industry average for a Chiropractor (census bureau), despite the company already increasing wages by 10% over the past year (Q4 2021 Earnings Call) to roughly $85,000. If you include bonuses, all-in salary goes up to around ~$106,000. However, although management cites a comparison to census bureau data to validate that they pay above industry average, we believe that comping JYNT salaries against those of solo and group practice doctors is a better picture of the true reality behind wages at the Joint.

This is because 1) census data on salaries across all chiropractors is likely weighed down by the inclusion of associates, whereas all JYNT doctors are full DCs, meaning they should earn significantly more, and 2) census data includes doctors working at general hospitals and other places, unlike solo/group practices who are direct competitors for JYNT’s target employees.

When compared with data from Chiro Economics, we see that the average solo DC makes an all-in total compensation of ~$124k (~16% higher) and a base of ~$89k. Additionally the average salary paid to a full-time employee across all job types (associates, solos, groups, etc.) was $102k. Joint DCs are working considerably higher workloads at a comparably lower wage to what they could possibly be making elsewhere.

"The average total compensation for solo DCs this year was $123,900 compared to $118,800 last year. The average total compensation for a DC practicing in a group setting jumped from $207,960 last year to $210,464 this year. Salaries for solo DCs averaged $82,500, an increase from $73,000 last year, and those participating in a group practice averaged $154,000."

— Chiro Economics 2021 Survey

d) Glassdoor reviews and Tegus interviews suggest that JYNT doctors are increasingly dissatisfied and overworked

Glassdoor reviews reveal an overarching declining trend in average employee rating from 2017 to 2022 (50 review moving average). More significantly, data also reveals a notable uptick in the number of employee complaints mentioning the keyword “hours” over the past 1.5 years, which supports the theory that JYNT doctors are dealing with overworking/overcapacity issues.

In addition, a Tegus interview with an Area Representative & Franchisee at competitor Nuspine cites how JYNT has been forced to take major steps to fix their negative work environment.

“Now they’re offering benefits, they’re just giving so much because they weren’t giving up. They were overworking, now they close between 2:00 and 2:45. They’re giving people lunch breaks. Their new locations are trying to give them break areas where a lot of them didn’t even really have a good break area.”

The same interview also describes how JYNT is known within the industry for treating their chiropractors poorly.

“But a lot of people and the schools, especially, feel that they mistreated their chiropractors. I remember I talked to a guy just a year and a half ago, he was like, "Oh, I would never pay a chiropractor more than $35 an hour." They just treated them not with respect, and that I feel that we have done from the beginning, that I hope we will have a better name out there and for kids coming out of school will start looking to us as a place that they want to be employed.”

The interview also complains that the negative perception that JYNT has given the industry as a whole, leading to a shortage of chiropractors.

“That's the one fear that we had going into it, was the shortage of chiropractors not only because of the kind of the way the schools look at The Joint and how they were treating chiropractors. So, from the get-go, we have to fight with that.”

Another interview with a Director of Clinical Training and Education at competitor HealthSource describes the negative perception of JYNT among the industry.

“I think going back to the being the passionate side, I think those people that are really passionate about being a chiropractor in what they want to create, I think they look at it as kind of a negative that they're taking something that they hold at this really high standard, and they're marginalizing it. They’re making it a commodity because there’s not a lot of doctors thought in it. They come in, they get an assessment, they adjust them and it’s out the door. So I think from that standpoint, it’s gotten a little bit of a negative perception.”

A recent interview with a Multi-Franchise Owner at Joint Chiropractic echoes these same points.

“…I guess The Joint doesn't have a really good reputation within the schools. And a lot of it is the schools they charge a lot of money to become a chiropractor. And so they want the chiropractor that are coming in to know that they're going to lead there and go open up their own clinic and make $0.25 million a year. And so when they find out that The Joint is hiring people and paying them between $80,000 and $100,000. I think that some of the clinics or some of the schools are afraid of that.”

Overall, these concerns about doctor dissatisfaction and a negative perception among of JYNT among the chiropractic industry pose a major concern for JYNT given that 40% of appointments are through referrals. Any compromise in the quality of doctor’s care, or in the number of doctors that JYNT is able to attract to fill open spots at new stores would significantly handicap future revenue growth.

Subpoint 1B: An increasingly difficult labor market further indicate that doctor growth and thus franchise growth will be near impossible

a) Tight labor market and competition for doctors from other solo/group practitioners has led to difficulty hiring new employees

In recent earnings calls, management cites the macroeconomic environment as the primary reason for doctor retention issues. Management says the tight labor market is why they raised average starting salary for their workers to $85k in Q3 2021.

“Like most employers we are navigating a challenging labor market that some are calling the great resignation”

— Q4 Earnings 2021

The aforementioned recent Tegus interview with a Multi-Franchise Owner at Joint Chiropractic affirms that this doctor shortage is still relevant for JYNT as of Q1 2022, making hiring doctors for new stores extremely challenging.

“And the biggest concern right now is just doctors seem to be a little bit more in short supply chiropractic doctors. So I think that's across the board that everyone is kind of struggling with Chiropractic right now and being able to find someone to do that.”

Additionally, when we interviewed the chiropractor at the Joint in Berkeley, she mentioned that there was a recent opening of a Joint clinic that could only manage 6 days a week given troubles finding available DCs. This is abnormal given that Joint prides themselves on being open all days of the week at the most available times across industry.

However, census data shows that total employed chiropractors in the US grew 3% YoY in 2021, and we estimate that JYNT’s target employee market (defined as all doctors working as sole proprietors or in group practices) grew 9% YoY in 2021, driven by a drop in the % of associates among the total workforce. We also defined JYNT’s hireable base as the target employee market less JYNT doctors, and took an arbitrary 50% discount to reflect the no. of doctors willing to change jobs in a given year) to arrive at our estimate for JYNT’s true hireable base, which showed healthy growth in 2021.

From our analysis, we find that the key driver of JYNT’s hiring struggles was that in 2020 and 2021, they only captured 1.34% and 0.18% of their true hireable base, unlike previous years where they hired 1.5-2.3% of ‘hireable’ doctors. There are several factors we can attribute this drop-off to.

1) Rising levels of doctor dissatisfaction and the aforementioned Tegus interview quotes regarding the negative perception of JYNT among chiropractic schools is making it harder to find doctors willing to work at JYNT.

2) A rapid increase in cash-based group practitioners (increase from 9.8% in 2018 to 24.2% in 2021) has nullified JYNT’s competitive advantages. Formerly, one of JYNT’s primary selling points to doctors was that their cash-only model allowed practitioners to focus only on patient-facing work without having to spend time on insurance paperwork. Now that a quarter of the group practice industry follows the same business model (and growing), JYNT’s cash-only model is no longer a significant differentiator for prospective employees. At the same time, industry quotes (from David Singer, DC, founder of David Singer Enterprises) note an increasing focus on volume-based practices, which indicates that more clinics will be competing to add doctors.

“More and more providers are moving toward a cash-based practice, and chiropractors have two options — they can sell high-ticket cash plans or they can do high-volume moderate fee schedules… the latter is the only way you can really continue to grow. You can develop a personal injury practice, but you have to be lucky enough to be in a state that still has good insurance for chiropractic care.”

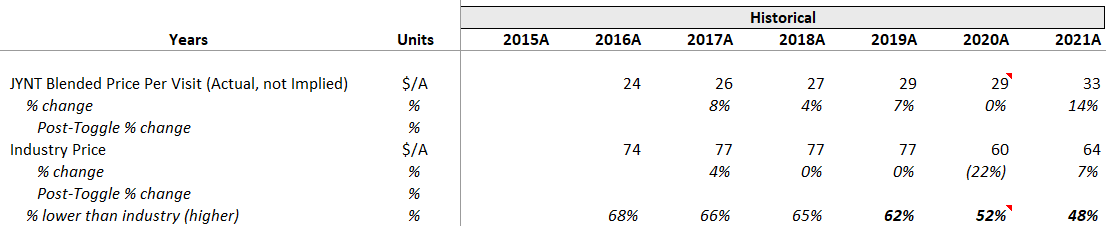

On a separate point, another key observation is that this industry trend towards cash-based chiropractors also coincides with the erosion of JYNT’s price advantages in recent years. Since 2016, JYNT’s price advantage has dropped from 68% lower than the industry to only 48% lower.

3) Growth in total doctor compensation over the past 3 years suggests doctors have higher leverage in salary negotiations due to the high level of demand to fill chiropractor positions. If this trend continues, JYNT will either have to make do with less doctors or continue upping average salary to stay competitive.

It is also worth noting that our projections are giving JYNT the benefit of the doubt by keeping % of total hireable constant in the next two years. In reality, it is likely that a tight labor market would lead to less people jumping from job to job, causing a lower % of hireable employees within the target doctor market. Currently, our model projects JYNT to hire 100-110 doctors a year through the forecast period, based on a 0.76% capture rate (lower than historical averages).

b) Another obstacle is that JYNT potentially faces an oversaturation of their target employee market. Our analysis ultimately suggests there are only enough doctors to reasonably build out another ~800 stores, compared to management guidance of ~1200.

JYNT’s total doctors employed has now rapidly grown to comprise ~6% of the total multi-practice chiropractor and associate workforce in the US. A Director of Clinical Training and Education at competitor HealthSource describes how, up until now, JYNT’s mass-hiring of chiropractors has made it difficult for other offices to hire new employees.

“They do take up a lot of doctors, so it’s harder for some of the other offices to find doctor associates because The Joint is employing a craft ton of them…there’s some that aren’t The Joint who have a little bit more of a negative light of it because it doesn’t have a lot of creativity and variation in their plan and it consumes a lot of chiropractic associates, so it’s harder to sometimes find an associate for your clinic.”

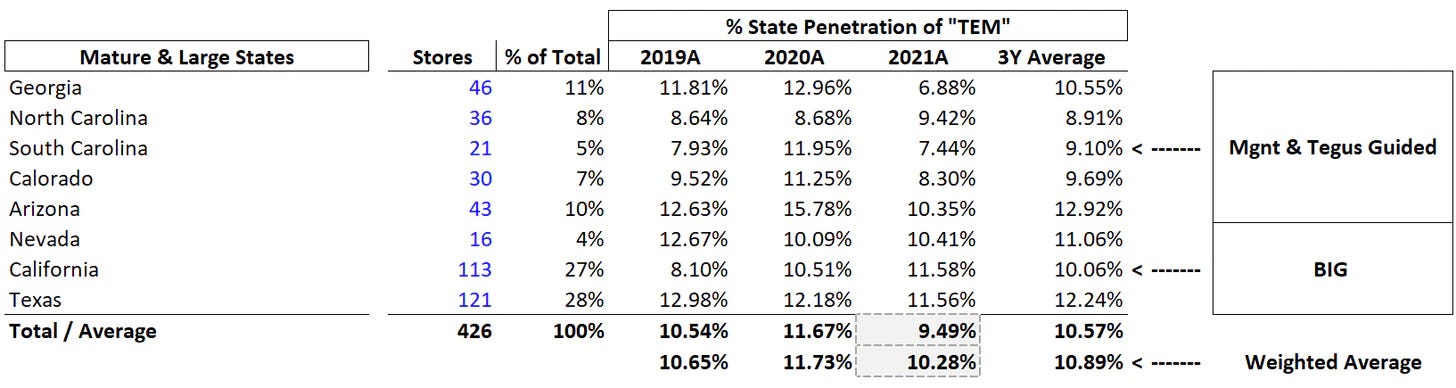

This is confirmed by our state-by-state analysis of JYNT clinics.

We calculated that the weighted average % of total doctors JYNT employed in a mature state was around 10.28%. in 2021. This is actually historically lower than in previous years, once again reflecting the fact that rather than facing an exodus of doctors from the workforce, JYNT was simply unable to capture a high percentage of existing workers in the most recent FY.

While we believe this labor market will likely worsen before getting better, we conservatively used 10.28% as the baseline assumption for what % of the state “TEM” JYNT could capture in any given state. With that, we were able to calculate how many stores JYNT could theoretically build-out, given that the SUPPLY of doctors was the only constraint. For instance, in North Carolina, with 920 doctors in 2021, assuming JYNT would be able to capture roughly 10.28%, each store employs about 2.41 doctors (at the top), North Carolina would be, at max, able to build out 39 stores.

Replicating this for all fifty states, we arrived at at an estimate of ~1,500-1,600 potential JYNT clinics, below management guidance of 1,900. Given JYNT has already built ~750 clinics, leaving room for only 800 clinics, compared to 1,200. Management guidance implies a ~12.5% % of State TEM captured.

In other words, JYNT would need to reach 120-130% of the FY2021 weighted average % State TEM captured to reach management guidance.

We ultimately believe that our numbers are on the conservative end, as many states may also end up having a demand constraint, not just a supply one, which we focus on.

JYNT’s expansion strategy is reliant on them consistently attracting large numbers of new doctors to staff new stores. As JYNT comprises a growing % of the overall multi-practice chiropractor workforce, combined with their growing negative perception among chiropractors, and the macro headwind that more doctors are moving away from practices similar to JYNT, it will be increasingly difficult for them to continue capturing enough doctors to fuel their franchise growth.

c) NuSpine is selling 150+ franchise licenses into a competitive labor market which further places a strain on JYNT’s future growth prospects

JYNT quotes several competitors on investor presentations and their 10K. But most competitors cited are not direct competitors as their target demographic and business models are very different to JYNT’s.

In contrast to companies like ChiroOne or 100% Chiropractic that run insurance-based models, JYNT is cash-only. One way to think of JYNT’s business model is as a commoditized chiropractic care provider; JYNT uses a private pay, non-insurance, cash-based model that seeks to absolve doctors of the hours of administrative paperwork they would encounter at a practice that employs an insurance-based payment system. What this ultimately means for JYNT is that, on a patient basis they don’t really compete against the other units cited in the 10K. Instead, JYNT appeals to segment of the population that has never experienced chiropractic care and is drawn in by the affordable and time efficient nature of JYNT’s product offering. In contrast customers who attend traditional units are looking for a more personalized and high-quality take on chiropractic care.

However, we think that a company that has flown under the radar of JYNT investors when it comes to posing a significant competitive threat is NuSpine, a company that has the same commoditized approach to chiropractic care, does not take insurance, is reliant on RDs, and has the same target demographic as JYNT. Nuspine’s growth is also occurring alongside an overarching industry shift towards cash-based high volume group practitioners, as mentioned in subpoint 1b, essentially proving that JYNT’s business model is easily replicable by competitors.

It’s easy to see why NuSpine is has been afforded little attention both by investors and JYNT. But the main reason being that as it stands today, they have approx. 9 open stores

However, as of the last two years, NuSpine Franchise Systems has earned the title of fastest growing chiropractic franchise in the US with approx. 166 Area Representatives licenses sold in 10 states in a little over a year.

Although NuSpine’s 9 stores are dwarfed by JYNT’s 706 (end of FY 2021), we believe that NuSpine’s rampant selling of licenses will fuel increased demand for chiropractors, as, in theory, these licenses must be opened within ~240 days of being signed. In particular, NuSpine’s encroachment into JYNT’s key expansion states – such as Texas where NuSpine awarded 46 AR licenses and has 22 franchises in development – is set to exacerbate the ongoing shortage of chiropractors and provide further negotiating leverage to JYNT’s prospective employees. Another cause for concern is that NuSpine RDs appear to employ aggressive techniques to lure customers away from JYNT, including undercutting JYNT’s already-low prices. We believe this is a textbook example of a prisoner’s dilemma where the competitor has explicitly benchmarked itself against the incumbent, ultimately manifesting itself in a pricing and quantity war, leaving both parties with increasingly low ROIC. An interview with a NuSpine RD echoes this point:

“And I think that we can thrive, and they can thrive. I always tell everybody two scenarios where I see this business going. Number one, everybody is like, well, if The Joint is already in that area, why do you want to be there. And I always say, have you ever seen a Home Depot without a Lowe's across the street or within a mile of each other.”

Our pricing is very similar. When we enter a market, we're about $10 less than them on the most popular packages, which is four visits a month. I think they charge $69, we charge $59. I know in San Diego, they charge $79, so our guys charge $69. So, since we're new to the market, one of the things that we're doing is like, well, if somebody went to The Joint and they quit or somebody is going to The Joint and they're not happy, why would they come to us?

What places JYNT at further risk is the moves that NuSpine has been making to capitalize on JYNT’s compromised brand image among the chiropractor community. The same interview with a NuSpine regional developer describes how NuSpine has been actively marketing themselves to new graduates from chiropractor schools.

“So, we're trying to team up as much as we can with schools. I am trying to reach out to students as much as we can to talk about how we can train them, talk about the future of chiropractic.”

Additionally, if there is still doubt over NuSpine posing a credible threat to JYNT, it worth it is mentioning that JYNT CEO, John Leonesio, an early backer of JYNT is now currently sitting on the board of NuSpine. An interview with a NuSpine RD points to this:

Yes. And get me understand a little bit more about the kind of the longer-term ambitions of NuSpine. You've got, I think, on your Board and one of your kind of minority investor in the business, is the kind of the founder of Massage Envy and the former Joint CEO.

Ultimately, these Tegus quotes, along with NuSpine’s ambitious selling of new franchise licenses, lead us to believe that NuSpine’s expansion plans will significantly increase competition for JYNT’s target doctors in what is an already challenging labor market.

Subpoint 1C: Past lawsuits and long breakeven periods make further openings of stores even harder

a) Past lawsuits from franchisees demonstrate a strained relationship

Throughout 2015 – 2016, The Joint was involved in a combined lawsuit from 6 franchises operating in Carmel valley (central California). These franchises sued alleging breach of contract, breach of implied covenant of good faith and fair dealing, wrongful termination, fraud, promissory fraud, negligent misrepresentation, and claims under or arising out of violations of Sections 31300, 31301, 31201, 31202 of the California Franchise Investment Law which essentially argues that the Joint did not disclose the appropriate information at the time of application with the proper documents. The case was resolved in December 2016 through a settlement which had the Joint pay $800k in cash ($130k per franchise), $100k in stock, and waive transfer fees which amount to about $90k in potential fees ($15k transfer fee).

In relation to gross revenues per franchise back in 2015 at around $240k, an estimate of net income based off ~13% net margins would have been around ~$31k, making this settlement per franchise nearly a 10x multiple based off earnings which is 3 turns higher than what franchises are getting fully acquired for in recent years (see model). If you extrapolate this to context of the case, it seems that the Joint was the party looking for a quick settlement and dismal of charges which would indicate that they must have felt some legitimate pressure from the claims being made. This case is indicative of a strained environment between franchise owners and the Joint while also shining light onto some potential misinformed promised within FDD files or any interactions between franchise and company.

This claim is further justified when looking at the July 2018 lawsuit of Anderson V. Roy and THE JOINT CORP (New Jersey). In this case, Mr. Anderson was swindled into investing into Mr. Roy’s franchise group called DBR Practice Management LLC that was formed for the purpose of operating and managing The Joint franchises. Mr. Anderson was a 22-year-old law student at the time and was convinced into investing $300k of his cash that was granted to him via an insurance claim due to being victimized in a drunk driving incident that left him nearly paralyzed. Mr. Roy, the Joint franchise owner and in this case a representative of the company themselves continuously pressured Mr. Anderson into investing additional funds on top of his $300k investment to open more franchises. “The Plaintiff predicts that the Defendant has built approximately four or five offices using the Plaintiff’s funds.”

For his initial investment, Mr. Anderson was given a measly 33% equity stake in DBR Practice Management LLC and a 5% interest paid monthly ($15k a year). This deal was made out to seem much better than it was given that Mr. Roy “personally guaranteed that if the Plaintiff invested his settlement money into “The Joint,” the Plaintiff would be “rich” very soon. Mr. Anderson was also coaxed into believed that he would be receiving “triple or quadruple” of his initial investment. However, if you run the numbers, the average start-up cost for a franchise is around ~$300k based off their FDD and projected take-home income is around $30k (or 10%) just for the first year without any proper store ramp up.

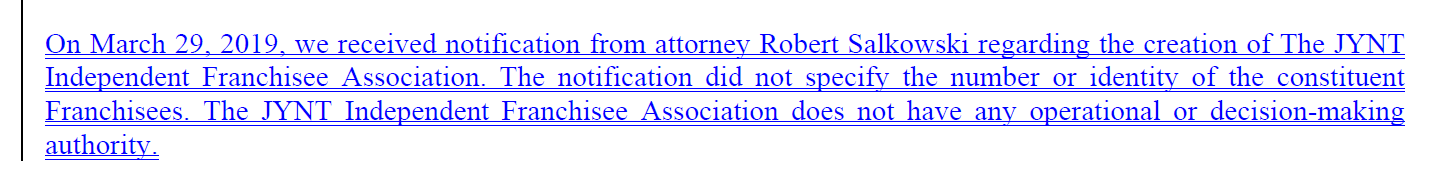

To add on to the already apparent issues with the franchisee base and the Joint, Zarco law served notification to the Joint in March 2019. This thesis was initially highlighted in a Seeking Alpha article by The Friendly Bear which later was confirmed by Zarco themselves in a blog post. Though the details of the case are not public, it goes to show that there does exist a rift between the Joint and their franchisee base as Zarco is known for being an extremely aggressive litigator against franchisors. As an example of their past work, they were the law firm behind Bryman v. LOCO that won the Plaintiffs a $8.8M verdict against El Pollo Loco for “breach of good faith” between the franchisor and the franchisee.

b) Long Breakeven period hidden by management using revenue as denominator instead of net income

Based off 2020 ramp data, the breakeven time based off net income (at a margin of around 13%) is around ~5 years which is not very good when put in conjunction with the bad reviews from franchise owners (lawsuits). This analysis points again towards the story line that attracting additional franchises may be getting harder.

Additionally, management reports to their potential franchise in their FDD a breakeven analysis graph that is based off Avg. Monthly Gross sales which shouldn’t be used as a proxy for breakeven given the recurring nature of their expense structure (wages and mandatory fees). The company has also stopped reporting this number in their most recent 2021 FDD which we see to be a sign of retreat.

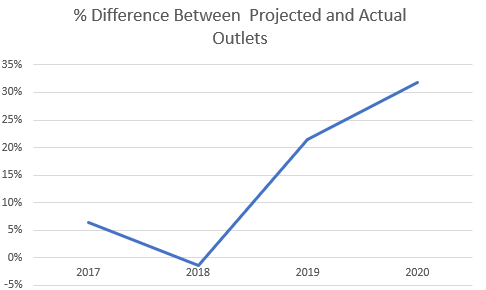

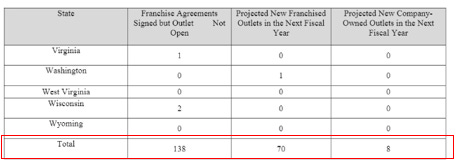

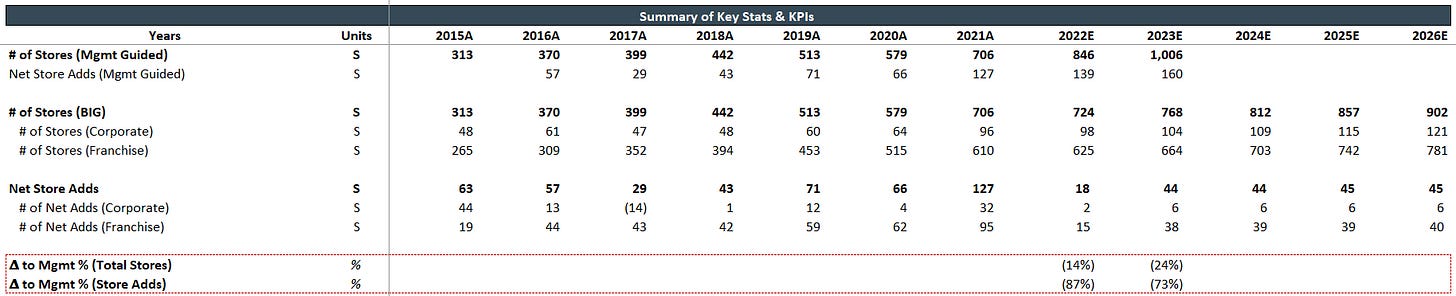

c) Missed store projections indicate overly optimistic management expectations / difficulty opening franchised outlets

As per their FDD JYNT reports projections for franchised outlet openings on a forward year basis. From FY17 to FY18 projections kept within a 5% range of actual results. But ever since the meteoric rise of the company’s stock price in 2019, the company has become increasingly less accurate in their projections for stores outlet opening.

There is a clear trend beginning in 2018 pointing to the idea that management has become increasingly optimistic with their projections and simultaneously less accurate.

We believe this discrepancy comes as a result two factors. One being corporate greed, reflected in management’s overly rosy projections to maintain investors enamored with the company’s growth prospects. But perhaps more importantly we believe this is due to an inherent problem with JYNT’s business model and certain industry tailwinds.

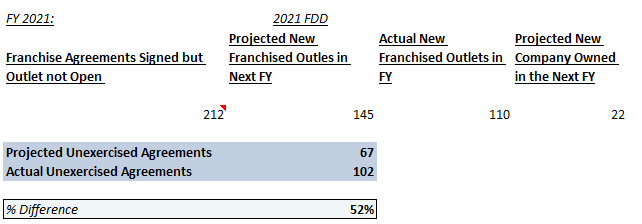

Within their FDD Joint reports a concrete timeline that franchisors must adhere to when opening a franchise. That timeline cites ~240 days from the time one signs a franchise agreement; this means that, at least in theory, all franchise agreements signed at FY end, should have opened by the end of the next FY.

Having said that JYNT discloses numbers for franchise agreements that have been signed but not yet opened at the end of each respective FY. This number of “franchise agreements signed but not yet open as outlets” disclosed on their FDD, is categorized as “clinics in development” on their investor presentations.

We are fully aware that it is unrealistic for JYNT to open clinics for all the agreements they sign, given the prospect of franchisers backing out or other logistical problems. Clearly JYNT’s management recognizes this, which is why they give themselves a margin for error when it comes to projecting the number of agreements that will go unexercised, i.e., will not result in a concrete outlet being built.

This relationship is illustrated as follows: JYNT will quote a number of agreements signed at FY end (as previously mentioned). They will then project new franchised outlets for the coming FY, and the resulting spread between the number of signed agreements and projected outlet openings represents the number of agreements that JYNT expect to go unexercised.

Logically as JYNT continues to grow at a rapid pace it is expected that there will be an increased number of contracts that will go unexercised. But the one thing that should stay constant is % spread between the projected unexercised and actual unexercised agreements.

As seen above JYNT is typically pretty accurate when it comes to projecting the number of agreements that will go unexercised out of their total agreement base, meaning they have a good grasp of challenges at hand when opening outlets. Hence, logically an inability to accurately forecast the amount of franchises agreements that will go unexercised would be indicative of a management team that does not clearly understand the factors at hand when it comes outlet openings.

When it comes to JYNT, we believe that the latter is true. Since FY 2017, JYNT has become increasingly worse at forecasting unexercised agreement amounts implying that franchisers are experiencing more and more difficulty when it comes to exercising their agreements once signed.

We believe this clear trend echoes our thesis, as it demonstrates that franchisers are encountering increased difficulty when it comes to translating their agreements into concrete outlets. Furthermore, we believe this trend is indicative of a company that in its pursuit of endless growth has spreads itself too thin, in the wake of a tight labor market set to change the dynamics of the chiropractic industry.

Another way of looking at these initial signs of poor performance is by looking at net openings where in 2021 the company missed projected store openings by ~34% only opening net 95 clinics versus their projected 145. This trend existed previously but not to the same degree with actual store openings only undershooting by ~15% in 2019 (59 versus 70 projected).

d) Potential headwinds in California expansion reinforces our bearish view on future store openings

Taking a closer look at the distribution of JYNT’s stores reveals that 41.5% of all store count growth has been concentrated in three key states – Florida (11.45%), California (13.49%) and Texas (16.54%). Within these key states, California and Texas pose the biggest cause for concern for JYNT.

Multiplying system-wide doctors per store by total stores in California and Texas reveals that, in each of these states, JYNT already hires 11.58% and 11.56% of the total chiropractor workforce (according to census data). This number is already significantly higher than the % of total workforce hired in states that management designates as ‘mature’ – Georgia (6.88%), North Carolina (9.42%). An additional headwind is that California, which has driven 22.36% of store count growth since 2015, has experienced 4 consecutive years of decline in total chiropractors employed.

Assuming this trend continues (with a 2% YoY decline in California’s chiropractor workforce), if JYNT keeps opening California stores at a rate in line with historical averages, this implies that they would have to be employing 19.56% of the total chiropractor workforce in the state. Once again, this boils down to our central thesis that JYNT’s expansion strategy is reliant on attracting new doctors at a rate which is near impossible given their negative reputation and the competitive labor market.

Even more concerning is that store growth in California has significantly underperformed management’s own projections in recent years. While this trend is true for management’s guidance across all states summed, the fact that it is particularly prevalent in a key expansion state is a red flag. Out of the past 4 years for which we have FDD data, California has missed on management projections for franchise openings and company-owned store openings in 3 of those years.

Subpoint 1D: We believe that rev/clinic is near its peak

We believe for both the owned/operated and franchised revenue per store has reached an inflection point where growth will begin to taper off in the years to come. For both segments, we estimate high single digit growth followed by a reversion to low single digits in the outer years.

a) Growth avenues seem slim

The jump in % of total available time per store for adjustments (discussed above) in 2021 from 53% -> 69% while not baking in peak hours which indicates that stores may already be at max capacity so driving more revenues would come from larger price increases which is not aligned with their business model given that their average pricing at around $33 is already higher than some existing Co-Pays out there at $15-$20 and more offices are moving to cash base as indicated by interviews and industry reports.

To simulate what this would look like if revenue growth continued to occur due to volume increases, we modeled in a ~22% CAGR for PVs each year (based off a 5 year average) keeping doctors per store at a slightly higher average than 2021 data. This results in average revenue per store growth at around a ~17.7% CAGR which is in-line with their historic growth trajectory for average revenues across all stores.

However, this level of volume growth would also imply that stores will begin to exceed MAX capacity by 2024 (% of total available time per store). This number doesn’t even factor in peak hours where given conservative assumptions, 2021 onwards would imply that clinics are already at MAX capacity.

Our estimates factor in this constraint on PV growth. Taking a more conservative approach to forecasting PV growth based off annual adjustments per doctor staying at around current levels and factoring a MAX capacity feasible (implied by % of total available time per store) to be around ~80%. With these assumptions, average revenue per store across the Joint looks to grow at around the same rates that we are estimating in our base case assumptions.

b) Through financial analysis of previously acquired franchised clinics, we seem to be reaching a peak revenue amount with slowing (single digit growth) growth.

We looked at 5 franchises that were reacquired by Joint over the past few years. These stores were all mature given that their balance of member deficit is near zero or positive. Clinic ramp data extrapolation indicates that these franchises are at least 5+ years old (max term before renewal is 10). The weighted average revenues of the disclosed reacquired stores are around ~$512,000 per clinic. And average growth rate is still around ~11% for these mature clinics. However, for three of franchises said growth is starting to taper off at only ~6% in 2018 at a level of $490k.

Based off these two factors, we believe it conservative to estimate a high single digit rev/clinic growth rate for the next few years based off a lower comp from the large number of reacquisitions and greenfield openings and tapering off into low single digits as clinics continue to be too busy.

Thesis 2: Management past antics are clouding their judgement on an effective franchise growth strategy

When it comes to JYNT’s management, the story is no more reassuring. A string of failed microcaps and franchises, 2 different auditors since 2014, and series of worrisome insider transaction are some examples of said shortcomings.

To start CEO, Peter Holt was installed as CEO and president as of Aug-2016. Previously, Holt served as COO from May 2016-June 2016.

Before joining JYNT, Peter Holt served as the CEO of Tasti D-Lite a chain of smoothie franchises that experienced a period of rapid growth where acquired another chain of frozen foods which saw them grow from 34 location in 2007 to 164 units by 2010. According to Tasti D-lite 2014 FDD their total units were sitting at around 127 (-22% Units closed), with the original franchises reportedly down to 34 units, before being acquired by Kahal Brands in 2015.

It is worth noting that James Amos, a current director on JYNT’s board was a part of the Tasti-d-lite story. In fact, John Amos previously served as the CEO of Tasti D-Lite where he stepped down in 2007 leaving the company to his friend Peter Holt. From interviews and by looking at Amos management of Tasti-d-Lite it is easy to see that Amos appears to have a “growth at all costs” mentality.

And although some might argue that this growth mentality is beneficial when it comes to building out a network of franchises, the reality is that it more and often than not it results in unrealistic expectations and a disjointed approach to franchise development.

We believe at JYNT the influence of Amos lives on through CEO Peter Holt, who has embraced the RD model and continues to guide overly rosy projections for future franchise growth.

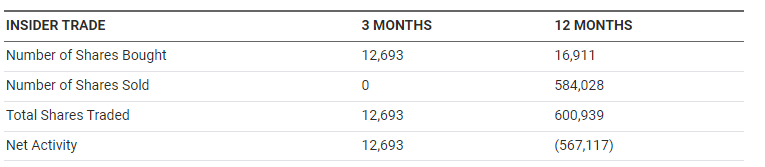

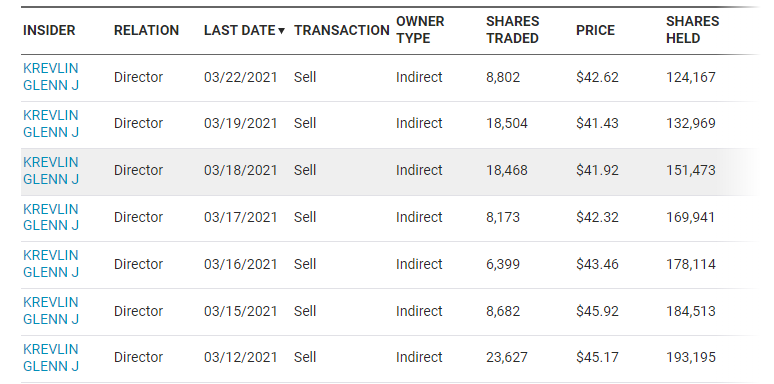

Subpoint 2A: Insider transaction paint an ominous picture of future prospects

The JYNT’s management and board of directors do not appear very bullish given they are by far net sellers of the company’s stock.

JYNT CFO Jack Singleton, has sold around approximately $1MM worth of stock, representing most of his position. James Amos, a member of the board of director has sold around $4MM worth of stock, representing most of his position. Matthew Rubel has sold approx. $1.5MM in stock, also representing most of his positionRonald DaVella, JYNT’s audit chair, has sold about $2MM in stock.

Additionally, within the last year Bandera Partners LLC a NY based hedge fund has unloaded nearly half of its stake in the company, representing nearly 900k shares sold.

Finally, Glenn Krevlin, a member of the board, member of audit committee, and founder of Glenhill Capital a fundamental investment manager has sold nearly 90% of his position, worth $14MM.

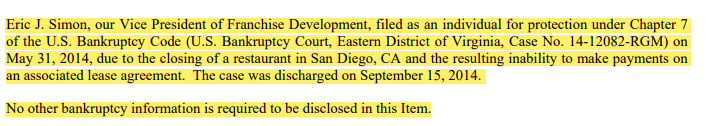

FDD also discloses that Eric Simon VP of Franchise sales and development since 2016 filed for bankruptcy in 2014.

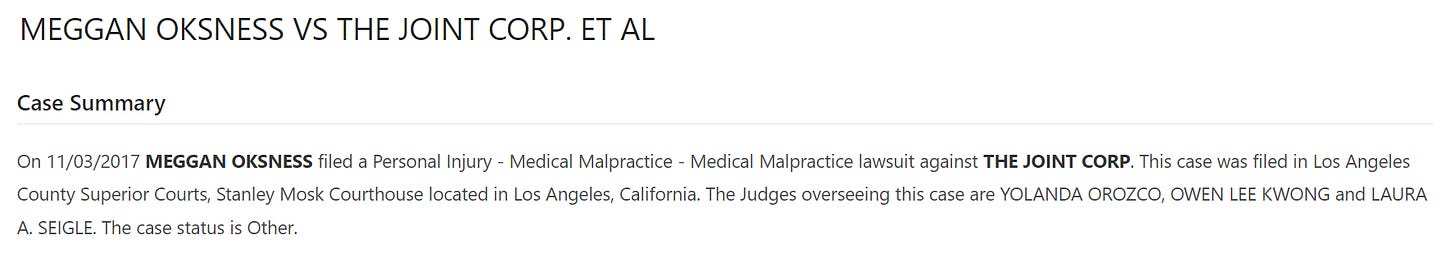

Thesis 3: Large amounts of customer complaints regarding overbilling, forged transactions, and other misconduct

Over the past few years JYNT has had its fair share of lawsuits and has even earned itself a reputation for issues with like overbilling, misconduct, and even forgery. Take, for example, a 2016 lawsuit alleging that JYNT had violated the Electronic Funds Act basis by overbilling over a California customer for a period of four-months after having cancelled their subscription.

Another example is a personal injury and medical malpractice lawsuit in November 2017, Meggan Oksness v The Joint Corp.

Unfortunately for JYNT this is not a one-off event; instead, the opposite appears to be true. Customer accounts cite difficulty when it comes to cancelling their JYNT subscriptions, in large part stemming of a cumbersome cancellation process. According to client accounts corporate policy specifies that in order to cancel subscriptions you must show up in person and at the same location where you originally signed up, which is strange given that memberships carry from franchise to franchise.

It may appear that we are cherry picking bad reviews, but the reality is there are dozens of reviews online, talking about how JYNT’s corporate policies are not only tedious but also prone to transactional mishaps. We believe that these factors coupled with examples of previous lawsuits related to forgery and overbilling point to some of the underlying shortcoming of JYNT’s business model.

JYNT’s store expansion since inception has been fueled primarily by their regional developer model. Under this model JYNT sells RDs licenses which then grants these RDs the right to sell a minimum number of franchises within their territory and to assist purchasers of those franchises to develop and operate their clinics. And although this regional developer model has it benefits, it does not lend itself to JYNT being able to ensure service quality and maintain airtight oversight over franchises. At the end JYNT recognizes that regional developers are independent operators over whom they have limited control. Unfortunately for JYNT this lack of control paired with a dependence on RDs has provided for an increased number of incidents with individual stores.

Subpoint 3A: Problems with past Auditor and New Auditor

In 2020 JYNT parted ways with their auditor of 8 years, Plante & Moran, and replaced them with BDO USA. The dismissal coming weeks after Plante & Moran highlighted the following crucial accounting matter:

For context David Steimel, The Plante & Moran audit partner in charge of the JYNT, had not audited any other public company in the past four years. In contrast the auditor they have most recently changed to, BDO USA has a record of faulty auditing. BDO USA has an average failure rate of 50.7%, that is the average failure rate of their audits according to PCOAB inspection reports from 2010-2019. For comparison the Public Accounting Oversight Board’s chief editor has been quoted saying that the typical failure range when looking at an audit ranges from 35%-40%.

Taken at face value this rating certainly does not appear to be good, but we believe that it becomes especially worrisome when looking at the types of mistakes BDO has repeatedly committed in the past. As previously mentioned, before BDO JYNT had worked with Plante & Moran for 8 years, that is until they published a critical audit matter – detailing the difficulty of auditing JYNT’s accounting for revenue given the company’s accounting policies.

Incidentally the same issue that Plante & and Moran detailed in their last report, is one the issues with which BDO has most experienced trouble historically. Furthermore is important to note that since changing auditor for FY 2020 , in the FY 2021 there is no section for aforementioned issue brought up by Plante & Moran. The final nail in the coffin is that JYNT even admits to “weakness in…internal control over financial reporting” as a key financial risk on their 10K!

Thesis 4: Street has modeled in unrealistic growth and valuation assumptions, setting the stage for major misses

Subpoint 4A: Comp-sets used by sell-side are uncomprehensive, likely assembled to retroactively justify high price targets

There are currently 6 sell-side firms covering JYNT, of which, we were able to get our hands on reports from five.

As shown above, the average price target hovers around $89, implying a 115x LTM EBITDA and 16x LTM revenue valuation. We think – given the characteristics Joint possesses – that this is absurdly high. More on this when we introduce our own comp-set. Most telling is how sell-side firms attempt to justify their valuations, using estimates from FY2023 and beyond, along with lackluster explanations regarding their choice of multiple.

“Our $100 price target for The Joint is based on our expectation investors will place an EV of 10x our discounted FY25 revenue estimate. This multiple is approximately in line with industry peer Planet Fitness (PLNT) which is trading at 10.9x FY22 revenue.”

— Lake Street Capital

“We reiterate our Buy rating and $90 price target which is based on 45x our FY23 EBITDA estimate of $25.4M (prev. $24.1M), a multiple above JYNT’s high unit growth consumer peer group at 26.1x given JYNT’s higher growth rate and higher than average LT unit growth potential.”

— Craig Hallum

“JYNT is on track for 1,000 clinics by the end of 2023, and we reiterate our BUY and $128 PT, based on 80x 2023E EBITDA of $22.9M”

— D.A. Davidson

“Our $75 price target is based on 8x 2023E revenue, or 52x 2023 EBITDA. JYNT's premium valuation is warranted, in our opinion, given the LT upside to JYNT's store base and AUV”

— Roth

Regardless, given that JYNT is trading far below many of these price targets, lets shift gears to the underlying comp-sets chosen, which may continue to play a role in JYNT’s premium multiples. Of the five sell-side firms, only two have disclosed their comp-set: Craig-Hallum, and Maxim-Group.

Craig-Hallum Comp-Set:

When compared to the set of comps chosen by Craig – which appear to be a set of fast-growing franchisee businesses – JYNT may appear somewhat expensive, but still seems to trade in-line with overall expectations, given its higher SSS and revenue growth. However, a closer inspection reveals a staggering difference:

(1) The Kura Sushi cited above is not the correct Kura Sushi. Kura Sushi Inc. (2695.T) operates on a “licensee” model, which although different from the franchise model, is fairly similar. Kura Sushi would therefore be comparable to Joint. However, the Kura Sushi used above is NASDAQ: KURA, the US subsidiary of the Japanese Kura Sushi Inc. (2695.T). The two are completely different – the US licensee only operates 30 stores (compared to 500 for the larger brand), and they are a “licensee” of the larger brand. That is, they are essentially a publicly traded franchisee of Kura. Despite not being comparable at all to JYNT, it skews up all the averages, helping justify the absurd price target slapped on at the end of the report.

(2) Shake Shack only derives 3% of its revenue from its franchise-isk segment. Shake Shack, too, is a licensee model. But, even if you overlook that, only 3% of its revenues are from royalties stemming from licenses – its basically NOT a franchisee business at all. Without the franchise similarity, all this does is compare a fast-food chain to a chiropractor business…

Overall, not only does the author of the Craig-Hallum report misunderstand the comparable companies but has selectively left out other franchisee businesses like McDonalds or Papa Johns, which would serve as better comparable, leading to averages that are more representative of how franchise businesses ought to trade.

Maxim Group Comp Set:

Unlike Craig-Hallum’s, Maxim simply comps Joint against other healthcare companies. Once again, this may seem fine, but two issues arise:

(1) None of these businesses’ models are like Joint. Brookdale and Capital Senior Living are operators of senior living homes, DaVita’s largest revenue segment is providing Kidney Care Services, LHC Group provides in-home healthcare services to older people, & RadNet does outpatient imaging services! The point is: the target customers are different, the payment model is different, the operating expenses are different, nearly everything is different about these comps besides the fact that they are broadly healthcare.

(2) These comps serve little purpose for Maxim’s valuation. That is, Maxim assumes a revenue multiple far higher than anything from the comp-set, and then justifies the arbitrarily higher multiple by explaining that “JYNT is a capital-light franchise model and therefore should trade a premium.” Issue is, this reasoning could be used to justify literally any multiple above the peer-set.

“Shares currently trade at an EV/revenue multiple of 7.0x our 2022 estimate, a significant premium to the peer average of 2.0x, excluding JYNT. Although we believe JYNT's capital-light franchise model, above peer revenue growth, and continued solid execution of its business model warrant a significant premium to its peers, we believe JYNT is fairly valued and we maintain our Hold rating.”

— Maxim Group

In light of the errors we spotted with sell-side’s comp-sets, we made our own, comprised of franchise businesses from various sectors.

The purpose of this being three-fold:

(1) We can average out industry risk with franchisee businesses from multiple sectors. This would make the comp-set more representative and reflective.

(2) With a larger size of franchises, we would arrive at averages across differing metrics that were less skewed and misleading.

(3) We can run linear regression between metrics and multiples to back into a less hand-wavy valuation of JYNT.

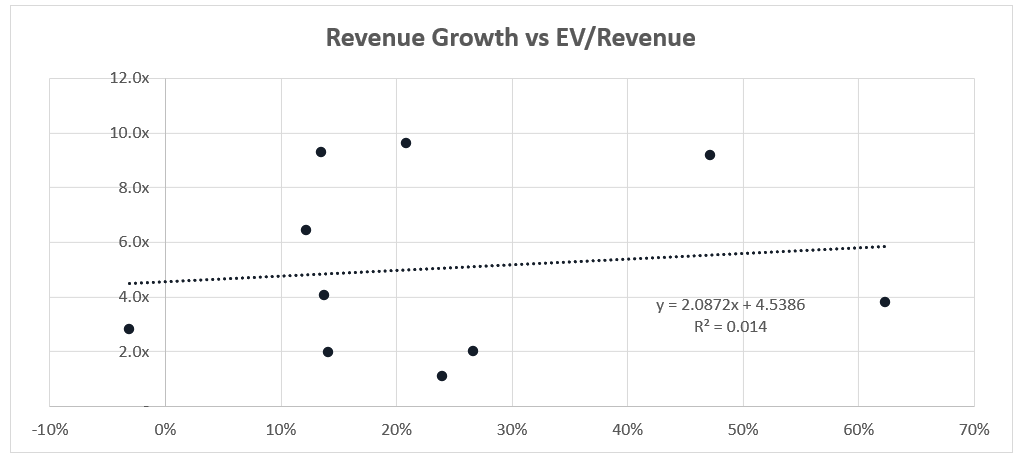

One thing we noticed across the sell-side reports was the lack of focus on margins – in particular, EBIT margins – and their relevance to valuation. Many reports justified premium multiples on the basis on faster growth, but our linear regression suggests that such relationship is insignificant or weak, with an R^2 of only .014.

Rather, we posit that EBIT margin is the most relevant metric for determining valuation of franchise businesses for two reasons:

(1) Revenue growth is a function of profitability. In franchise business models, such as JYNT or PLNT, all future growth rests on the willingness and ease of opening franchises. The willingness must come from potential franchisees, who must see opening a store as a profitable investment. For instance, many PLNT stores are opened and managed by PE shops, as PLNT’s 30% EBIT margins make it a high ROI investment. As we showed previously, however, because of JYNT’s lackluster EBIT margins (7% in 2020), it takes over 5 years on average for a franchisee to BREAK-EVEN on their initial investment, and that’s not even accounting for opportunity cost. Thus, four-wall profitability drives growth.

(2) By incorporating D&A expenses, the EBIT margin reflects which companies are a larger % corporate-owned (as owning corporate-stores means larger cap-ex expenses and PP&E). A lower EBIT margin therefore implies a higher corporate-owned segment, which deserves a discounted revenue multiple – because corporate-owned stores tend to grow top-line at the cost of being margin-dilutive (which means the revenue multiple should contract, as you’ll get less FCF per $1 of revenue). Thus, a lower EBIT margin should command a discounted revenue multiple to reflect the dilutive aspect of developing corporate-stores.

This seems to be the case as our linear regression using EBIT margin is far stronger:

Ultimately, using the equation resulting from the linear regression using EBIT margin, we were able to back into an implied EV/Revenue multiple, and a respective price target using comps. Our implied EV/NTM Revenue multiple came-in at about 1.2x, given JYNT’s lackluster EBIT margin of only 7%. Given rising G&A due to project wage increases, we do not see this margin expanding much going forward. Thus, we believe the 1.2x NTM revenue multiple is justified.

Still, given that JYNT is growing at 30%, which is about 11% above the average, we decided to bump up the revenue multiple by 1x to account for it. We want to stay conservative – even though we project only about 11% revenue growth going forward – a major decline from the previous year. Ultimately, using the implied EV/NTM Revenue multiple JYNT should trade somewhere in the ~$15, nearly 50% below current levels.

Subpoint 4B: Sell-side remains deeply indoctrinated by management’s story regarding store openings and same-store sales growth

As we explained in our first thesis point – a reflexive combination of industry headwinds and appalling work conditions make it unlikely that JYNT can achieve its target of 1,000 clinics opened by FY2023 end or continue to grow its SSS at a rapid clip.

The street, however, is asleep at the wheel, continuing to fervently believe in this story:

“The company continues to progress on schedule towards its goal of 1,000 clinics by 2023, and provided 2022 total clinic opening guidance of 140-170.”

— Maxim Group, February 2022

“If you can stand some short-term pain for what we believe will be an outstanding long-term gain, we encourage you to buy JYNT shares now. Huge TAM, great model, exceptional leadership, and strong financial position. Peter Hold, Jake Singleton, and the team are building a winner at The Joint.”

— Lake Street Capital, February 2022

“JYNT is on track for 1,000 clinics by the end of 2023, and we reiterate our BUY and $128 PT, based on 80x 2023E EBITDA of $22.9M”

— D.A. Davidson, November 2021

“The Joint remains on track to reach 1,000+ clinics in the system by the end of FY23 which would imply a 20%+ unit growth CAGR over the next two years. We expect the JYNT to deliver close to 30% revenue growth in FY22”

— Craig Hallum, February 2022

What is infinitely more concerning is the lack of recognition regarding the doctor shortage that JYNT is facing, and the unit economic deviation from prior years. Just look at some of the “risk” sections of these sell-side reports; clearly little thought has been put into this.

As a result of our variance on store-openings and same-store sales growth, we are nearly (23%) below the Street on revenue, and nearly (40%) below on EBITDA by FY2023. While consensus numbers don’t track beyond that, we believe we are likely even more variant 5-years out.

Furthermore, we are (73%) below on new store adds compared to management guidance in FY2023.

We believe that going forward, JYNT’s unsustainable practices will unravel, and print misses will fuel multiple re-ratings and price contraction of ~50%.

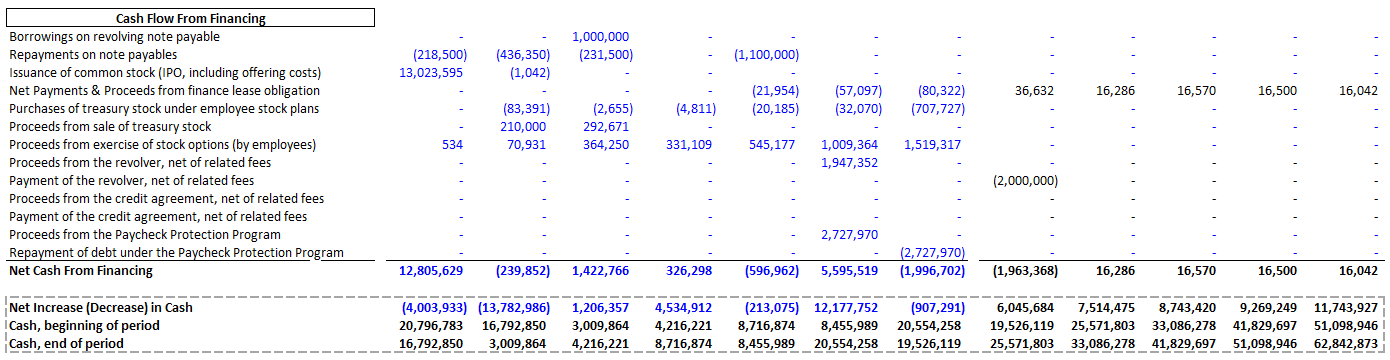

Valuation: Using a weighted average of our bear/base/bull case, our comp set, and the current share price, we believe that JYNT has >48% downside (blended PT of $16.38) from current levels ($30.52), despite declining over 10% over the last week.

An important clarification – we choose to subtract “Acquisition of Corporate Stores” along with “Reacquisition of Regional Development Rights” in our calculation of UFCF because we think it is necessary for the continued growth for the company, given management guidance of its continued acquiring of franchise stores and turning them into corporate stores.

For the sake of simplicity and time, we will only be focusing on explaining the few core drivers in the model for varying scenarios (bull, bear, base), rather than attempting to explain all of the assumptions.

Doctors Per Store:

Base Case: We assumed 2.50 doctors/store in our base case because our utilization calculations (seen in previously) suggest that many stores are already at overcapacity during peak hours. Ideally, to eliminate overcapacity issues, JYNT would need more than 2.50 doctors/store, but we are bearish on how much JYNT would change its unsustainable practices. The slight bounce-back thus a small desire to quench the problem (as seen with its wage increase) and we believe that keeping any lower would be an unsustainable practice, leading to doctor burnout and a bad customer experience.

Bear Case: We assumed 2.89 doctors/store in our bear case – in this scenario, JYNT would move to eliminate overcapacity and restore a lower-stress work environment by hiring more doctors, even at the cost of missing quarterly and annual guidance on store openings. We chose 2.89 as it reflects the number of doctors JYNT had in 2020, prior to experiencing the intense doctor shortage.

Bull Case: We assumed two years with a .05 step-down in doctors/store, flatlining at 2.31. We choose this as the bull-case because it reflects what we believe to be the true upper-limit on how much JYNT can squeeze out of each doctor without causing a complete meltdown and deterioration of the customer experience.

TEM Captured:

Base Case: We assumed a .76% capturing of the TEM in the base – a simple average between the last two years of % TEM captured. This reflects a recovery from the year prior (given wage hikes, and a small recovery in image due to marketing), but not a full one by any means. We think that management’s decision to overwork doctors in the face of a looming doctor shortage has served to confirm rumors of their terrible work environment, which will dampen prospects of % TEM captured far into the future.

Bear Case: We assumed a .18% capturing of the TEM in the bear – simply dragging out the last year, and if JYNT cannot recover at all from its last year’s performance. It will thus continue to face a damning shortage, making # of doctors hired incredibly low.

Bull Case: We assumed a 1.68% capturing of the TEM in the bull – an average of the four years prior to the last, when JYNT didn’t struggle much with hiring new doctors. This bull case assumes essentially a full recovery in JYNT’s doctor recruiting abilities.

Employee Distribution Shift:

Base Case: For the base case, we assumed a slowdown-tick in the % of doctors that are sole proprietorships, dropping about .5% each year. This is mostly a conservative reversion towards the mean assumption.

Bear Case: We assumed a gradual recovery of doctors moving back from sole proprietorship towards associate and business partners (reaching its previous % of total doctors of 66.5% by 2023), with half of the doctors leaving sole proprietorship moving back to associate/employees, and the other half moving business partners. We think this is the most bearish view – as it would imply a shrinking hirable base overall, with some people entering fields that are not in the “target” doctor base for hire.

Bull Case: We assume a continued push toward sole proprietorships (100 bps increase each year) over associate/employees, meaning a larger hirable base. Because this breaks out of historical trends and percentages, we are skeptical this would be the case.

Average Revenue Per Clinic (Corporate & Franchise):

Base Case: JYNT is able to reach roughly 650k revenue per clinic by 2026, which falls in line with results from the average “mature” clinic.

Bear Case: JYNT reaches only 600k revenue per clinic by 2026 – doctors are experiencing an unsustainable uptick in workload and clinics are close to capacity leaving minimal room for further growth.

Bull Case: Our analysis indicates that a top tier clinic can capture 750k revenue with 2.3 doctors. Using this as the upper limit for the average JYNT clinic, we project average revenue per clinic to arrive at this number by 2026.

Long-Term Growth Rate:

Base Case: 3% growth – still has some room to expand, grows at a rate above inflation.

Bear Case: 2% growth – business becomes mature by 2026.

Bull Case: 4% growth – business continues to grow.

All-In Doctor Wage (Including Bonus)

Base Case: Moderately tight labor market and poor impression among chiropractor community forces JYNT to raise wages at a rate slightly above historical averages (6% YoY in 2022 dropping down to 2% YoY in 2026)

Bear Case: Extremely tight labor market and inability to capture new doctors forces JYNT to raise wages 9% YoY in 2022, down to 3% YoY in 2026.

Bull Case: Labor shortage is resolved, doctors do not gain negotiating leverage, wages grow at pace with inflation (2% YoY).

THE TEAM (Sze-Yu on the left, Chris cracking the back, Kevin getting his back cracked, Will on the right, Emilio second on the right)

Appendix:

WACC Calculation:

Comp-Set:

Debt Schedule:

Expense Drivers:

Balance Sheet Drivers:

Cash Flow Drivers:

Cap-ex, Acquisitions, & D&A Build

Income Statement:

Balance Sheet:

Cash Flow Statement:

Revenue Build:

Legal Disclaimer: As of the publication date of this report, Berkeley Investment Group have a short position in the stock of The Joint Corp. In addition, others that contributed research to this report and others that we have shared our research with likewise may have short positions in the stock of The Joint. The Authors stand to realize gains in the event that the price of the stock decreases. Following publication of the report, the Authors may transact in the securities of the company covered herein. This article is not investment advice and represents the opinions of its authors, Berkeley Investment Group. You can reach the authors by email at berkeleyinvestmentgroup@gmail.com. This document is for informational purposes only. All the information contained herein are from public sources believed to be accurate and reliable. Berkeley Investment Group make no representation either expressed or implied as to the accuracy, timeliness, or completeness of any such information or results obtained from its use. All opinions are subject to change without notice.

Thanks for the write-up, wanted to know if the valuation model if available for readers to have a look into?

Well this was a homerun. Good work guys, thanks for the the tip!